Grotuxiv:

Expand Market Perspective Through Grotuxiv

Sign up now

Sign up now

Entering the world of investing often feels complex, with shifting prices and constant streams of information creating confusion. The site does not deliver lessons itself, but it serves as a direct pathway to credible educational providers. By facilitating these connections, it becomes easier to find guidance that breaks down technical concepts into understandable insights.

The financial landscape contains an overwhelming amount of content, from articles to online sessions and tutorials. Sorting through it all can quickly become exhausting. Grotuxiv simplifies this process by introducing individuals to educators who communicate clearly and focus on practical understanding rather than unnecessary complexity.

Conflicting opinions and endless advice can leave anyone uncertain about the next step. The Site reduces that uncertainty by directing users toward structured educational support. Through experienced educators, information is delivered in a straightforward and practical manner, helping learners approach investing with greater clarity.

Beginning an investment journey can feel unfamiliar at first. The early stages often require patience, but steady progress builds understanding. By focusing on foundational concepts, the broader framework gradually becomes easier to interpret. With consistency, confidence develops naturally and decisions become more deliberate.

Investing extends beyond reading charts or tracking numbers. It involves cultivating a thoughtful decision making mindset. As knowledge expands, patterns begin to connect, helping clarify how individual elements contribute to the overall picture. Each concept strengthens analytical thinking and supports more measured choices.

The volume of financial content available today can be overwhelming. Grotuxiv simplifies the process by directing individuals toward trusted educational providers. Whether exploring fundamentals or refining advanced understanding, the Site keeps learning structured and focused.

What distinguishes Grotuxiv is its flexible structure. Learning is not restricted to a single viewpoint or source. Instead, it connects learners with diverse educators, allowing education to progress at a comfortable pace and according to individual preferences.

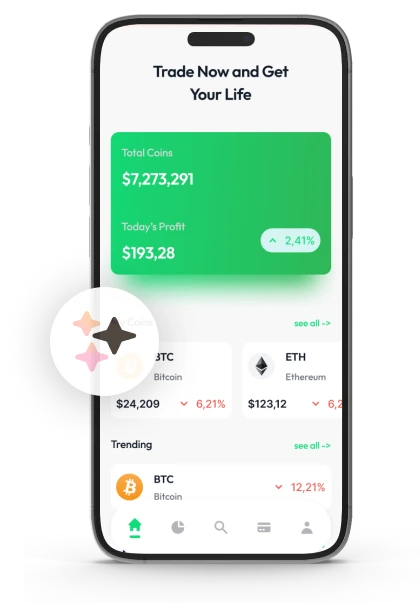

Registration is designed to be simple and efficient, allowing a smooth entry without pressure. The purpose is clear: to introduce you to educational providers that align with your investment objectives. It serves as the starting framework for a learning process that develops gradually and comfortably.

After completing registration, connections are established with educational firms that reflect your areas of interest. These providers communicate directly, outlining their methodologies and available resources. With multiple learning formats offered, you can evaluate the options and select what best fits your preferences.

Enrollment marks the beginning of a broader journey. Immediate action is not required. Instead, the emphasis is placed on building a reliable educational base. By reviewing materials carefully and exploring various approaches, steady and informed progress becomes achievable over time.

Grasping fundamental concepts is essential when entering the investment landscape. Through Grotuxiv, connections are made with educational providers who explain the mechanics behind financial markets. Learners gain insight into what influences price fluctuations, how supply and demand interact, and how investor sentiment impacts market direction.

Identifying patterns plays a central role in long term development. As knowledge expands, it becomes easier to interpret shifts in market sentiment, including periods of uncertainty or optimism. Recognizing these behavioral cycles supports more balanced and analytical evaluation.

Investment paths differ from one individual to another. The site supports a tailored learning experience by linking users with educators suited to their objectives. This allows educational focus to align directly with personal financial goals.

Risk management remains a core component of investing. With structured guidance from experienced educators, learners explore methods for evaluating uncertainty and adjusting strategies responsibly. Preparation and adaptability become central themes in building resilience.

Investment education evolves over time. Reviewing past decisions, assessing outcomes, and refining approaches help sharpen strategic thinking. Gradual improvement leads to greater clarity and a more disciplined mindset.

At Grotuxiv, the primary objective is to introduce individuals to independent educational providers offering structured investment insights. There is no requirement to rely on a single source or method. The Site is designed to encourage exploration, giving learners the flexibility to evaluate multiple educational perspectives.

The learning process begins with clear and accessible information. No specific direction is imposed, and there is no promotional bias toward any single pathway. The focus remains on presenting balanced knowledge that simplifies foundational investment concepts.

The relationships established through the site form the basis of continued development. By building reliable educational connections, learners gain greater assurance in their decision making abilities. Over time, expanded understanding contributes to clearer, more confident financial evaluations.

A strong base is essential for long term investment success. When technical ideas are presented clearly, even advanced topics become manageable. Rather than reacting impulsively to every market movement, a measured and analytical mindset supports more thoughtful evaluation and informed decisions.

The learning journey is organized for clarity and accessibility. Registration is simple and efficient, providing prompt access to reliable educational materials. This approach minimizes confusion and encourages steady development. By progressing step by step, knowledge deepens naturally while confidence strengthens over time.

A well defined structure is essential when entering the investment landscape. Financial concepts that initially seem technical become manageable when explained with clarity. Instead of reacting emotionally to short term market shifts, a disciplined learning framework allows time for reflection, understanding, and steady progress.

Objective information plays a central role in responsible decision making. The site does not promote specific viewpoints or endorse individual providers. Its role is to connect learners with independent educational firms, maintaining a neutral environment that supports open exploration.

Clear communication is fundamental to effective learning. Many Sites blend opinions with promotional messaging, creating confusion. Grotuxiv maintains focus on straightforward, unbiased educational connections, ensuring transparency and clarity throughout the learning process.

Investment knowledge develops progressively. Each concept builds upon previous understanding, forming a cohesive foundation over time. Meaningful growth occurs through careful study, thoughtful questioning, and consistent engagement rather than rushed consumption of information.

Setting realistic expectations is an important part of any learning process. This Site does not deliver direct instruction or operate under a structured syllabus. Its role is to introduce individuals to third party educational providers that focus specifically on investment learning.

The objective is straightforward: to connect you with independent firms that provide meaningful insight into financial markets. Through these connections, you gain access to essential foundational concepts while retaining full independence in how you choose to explore them.

There are no guarantees of rapid outcomes or standardized formulas. The structure remains adaptable, allowing you to progress steadily and comfortably without pressure to follow a rigid or predefined route.

At Grotuxiv, learning about investments is approached with care and consistency. There are no claims of rapid financial gains or guaranteed outcomes. The Site does not provide individualized advice or attempt to forecast market behavior.

Sound investing requires patience rather than urgency. Markets move in cycles, and meaningful understanding develops over time. Taking space to analyze information and reflect on insights leads to more deliberate, informed decisions instead of reactive responses to short term changes.

Beginning the process is uncomplicated. Registration is designed to be quick and accessible, creating a pathway to reputable educational providers. With no strict timelines or imposed targets, you are free to expand your knowledge gradually and align your decisions with personal objectives.

Investment learning begins with understanding market mechanics. Instead of offering direct recommendations, Grotuxiv emphasizes identifying the forces that influence price behavior. Market fluctuations, trend cycles, and shifts in investor sentiment are all driven by measurable factors that can be studied and interpreted with greater clarity over time.

An important element of this process involves examining recurring market behaviors. Reviewing previous cycles can reveal patterns that appear under similar conditions. However, while historical analysis provides perspective, it should not be viewed as an exact blueprint for future outcomes.

Grotuxiv serves one clear function: connecting individuals with independent investment education providers. The Site does not create or deliver its own instructional content.

There are no internal programs, structured modules, or guided coursework offered. This transparent model ensures expectations are set clearly from the outset, eliminating uncertainty about the Site’s role.

Getting started requires only basic information, your name, email address, and phone number. There are no lengthy applications or complex steps. This streamlined process keeps the focus on connecting you with credible educational resources that introduce you to investment fundamentals.

The Site maintains a neutral position, allowing educational providers to present their own insights once a connection is made. This open structure gives you the opportunity to compare different viewpoints and select the learning style that aligns with your objectives.

After being introduced to educational firms, your progression depends on active engagement. Exploring materials thoroughly, asking thoughtful questions, and evaluating concepts carefully encourages deeper comprehension and independent reasoning.

Trust is established through clarity and realistic expectations. The site does not promote specific decisions or guarantee outcomes. Its purpose remains consistent: to connect you with independent educational firms while preserving your autonomy in shaping your learning experience.

Effective investment education depends on clearly defined responsibilities. Educators establish the foundation by outlining essential principles, interpreting market activity, and examining behavioral influences that shape financial trends. While they provide analysis and context, the responsibility for applying that knowledge remains with the learner, encouraging independent judgment and development.

The learner’s contribution is equally significant. Progress is not achieved through passive reading alone but through thoughtful engagement. Asking critical questions, evaluating different viewpoints, and focusing on areas of interest strengthen understanding. A well organized learning setting reduces unnecessary complexity, creating space for careful exploration rather than rushed conclusions.

Investment education is not centered on quick fixes or simplified formulas. It focuses on building comprehensive knowledge of how financial markets operate. This includes understanding core principles, recognizing the roles of various market participants, and examining how historical developments continue to shape present conditions.

The site functions as a connector rather than a direct educator. It links individuals with independent firms that specialize in investment instruction. Through these connections, learners engage with experienced educators who promote analytical thinking and structured exploration.

Financial education does not promise guaranteed outcomes or universal strategies. Instead, it strengthens the ability to interpret information, identify recurring market behaviors, and evaluate opportunities with greater awareness. Over time, this foundation supports more confident and independent decision making.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |